Quick Take

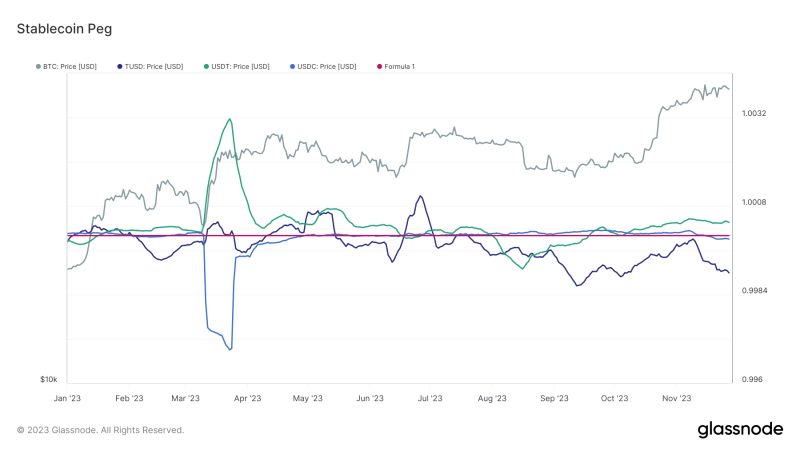

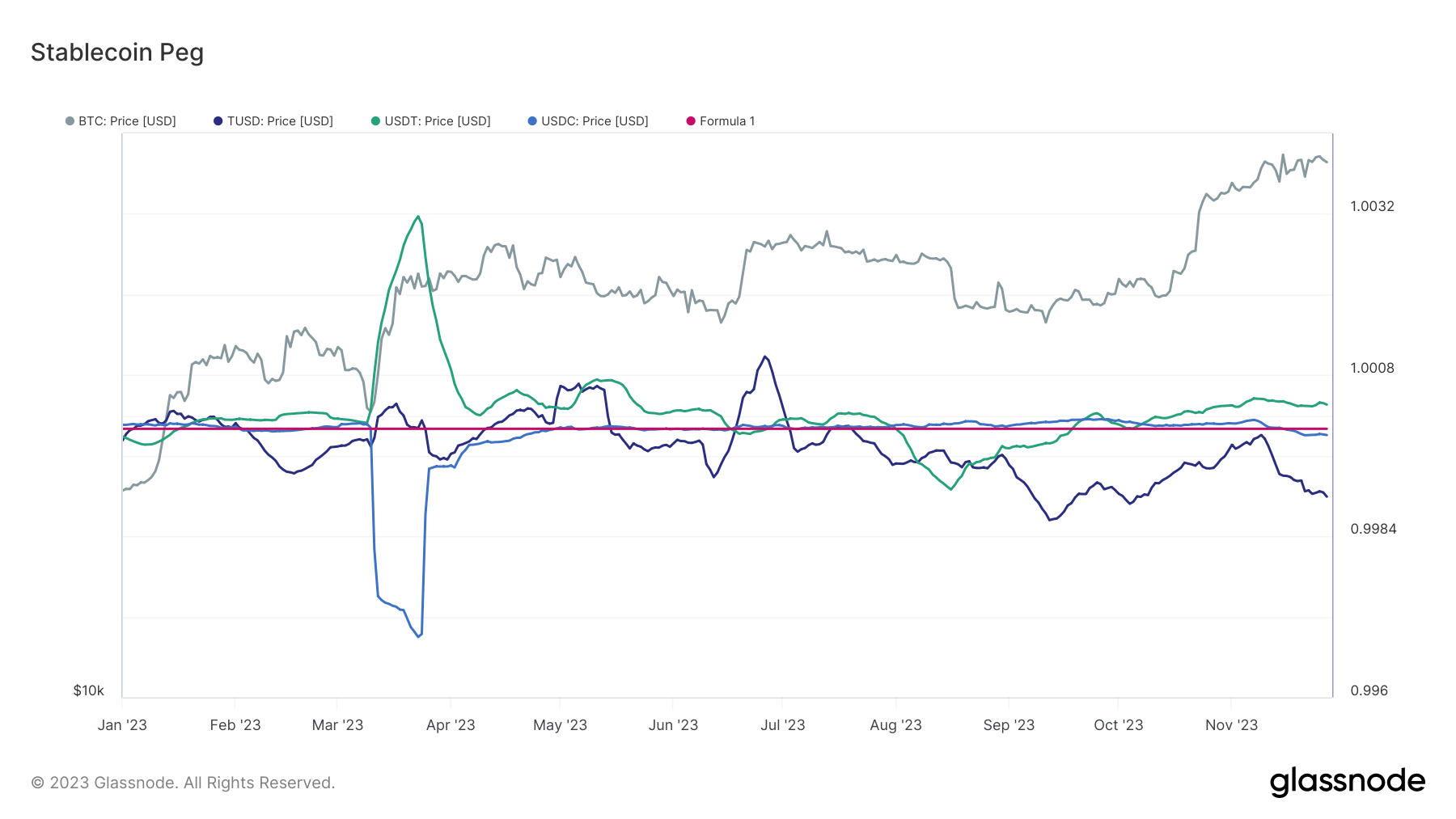

While the core purpose of stablecoins like USDT, USDC, and TUSD is to equate to $1, an intriguing pattern of fluctuating price movements emerges upon close scrutiny. By employing a 14-day moving average to smooth out the price variations, we discern noticeable disparities in their respective trajectories.

USDT, after trading at a discount to $1 from July to September, has shifted to trading at a slight premium in recent months. This could indicate a growth in demand for USDT despite its pegged value, possibly due to its widespread adoption and liquidity.

In contrast, USDC, which remained steadfastly anchored to $1 following the banking collapse in March 2023, is now experiencing a slight depreciation. The precise reasons for this relatively minor deviation are yet to be determined, but USDC dominance has dropped below 20% as the circulating supply continues to dwindle.

TUSD, however, exhibits the most pronounced discount, reaching one of its lowest for the year, despite trading within a cent of a dollar.

The post Price fluctuations in stablecoins spotlight diverging market sentiments appeared first on CryptoSlate.