Bitcoin’s (BTC) price has fallen dramatically in the past 24 hours, declining over 7% and briefly tapping the $40,650 level.

This latest crypto market crash has investors wondering if now is the time to “buy the dip” or cut their losses and sell.

While Bitcoin’s future remains uncertain, a new project called Bitcoin Minetrix (BTCMTX) has defied the bearish momentum, raising over $5 million in its presale ICO.

Bitcoin Bulls Stunned as Price Drops Over 7%

The BTC price has reversed sharply since Friday’s high of $44,730, with the coin now hovering around $42,150 at the time of writing.

Bitcoin did drop lower than this in the early hours of Monday morning, yet has retraced some of its losses since then.

This decline wiped out most of the gains made during last week’s bull run – prompting an uptick in investor uncertainty.

Other major cryptocurrencies, including Ethereum (ETH) and XRP (XRP), have also posted significant losses in the past 24 hours.

More than $355 million worth of long positions were liquidated, demonstrating how overleveraged and risky the crypto market remains.

Expectations of spot Bitcoin ETF approvals and future Fed interest rate cuts have driven much of the momentum in the past three months.

Yet, questions still need to be answered over whether these factors can continue to support market growth.

Regardless, the Crypto Fear & Greed Index remains at 74 – its highest in over two years.

Investors Ponder Whether to Buy the Dip or Exit the Market

With Bitcoin’s price suddenly plunging, some investors are wondering whether this is a prime moment to buy the dip or if it’s the start of a broader sell-off.

Long-term crypto bulls see this as a chance to buy BTC at a discount relative to its local high.

However, the flash crash also signals that the market remains highly volatile, and more downside could follow.

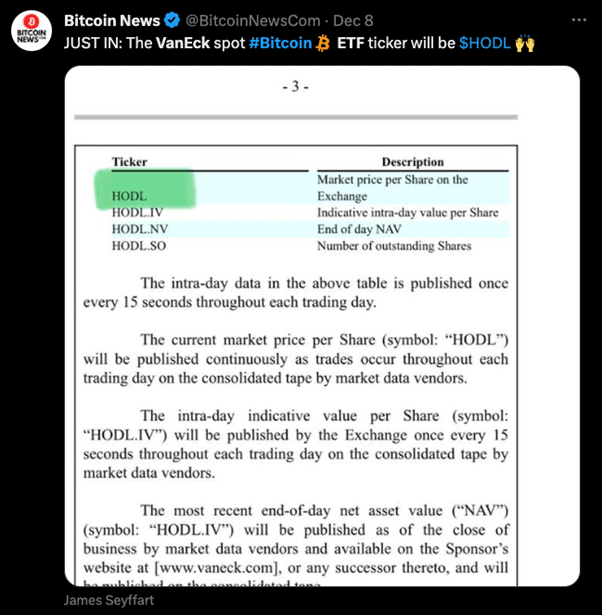

Looking at the fundamentals, asset manager VanEck just filed another amended application for a spot Bitcoin ETF with the SEC.

The proposed fund even has the ticker “HODL,” playing into crypto lingo about holding through ups and downs.

While SEC approval is still pending, momentum is building as more mainstream giants apply for Bitcoin ETFs.

If an ETF gets the green light in early 2024, as many analysts predict, it could bring a flood of new capital into Bitcoin – potentially driving its price higher.

So, for Bitcoin bulls who remain confident in the coin’s long-term trajectory, this pullback may be the ideal buying opportunity before the next leg up.

New “Stake-to-Mine” Platform Bitcoin Minetrix Emerges as Rising BTC Alternative

With Bitcoin still trying to find its footing after the latest price plunge, some investors may be looking for alternatives with more stability and upside potential.

One emerging project catching significant buzz is Bitcoin Minetrix (BTCMTX), which has already raised over $5 million in its ongoing presale ICO.

Bitcoin Minetrix introduces an innovative “Stake-to-Mine” model that allows users to earn BTC by staking their BTCMTX tokens.

This approach democratizes and opens up Bitcoin mining to a broader audience.

On top of Stake-to-Mine, Bitcoin Minetrix’s platform also features a staking protocol where users can lock up their BTCMTX and earn yields of 117% per year.

The accessibility of Bitcoin Minetrix’s model has resonated with the crypto community.

More than 6,400 people have joined the project’s Telegram channel, indicating a growing interest in Bitcoin Minetrix’s utility.

The presale currently offers BTCMTX tokens at an affordable price of $0.0121, although this price will increase in the days and weeks ahead.

Once the presale ends, the development team plans to list BTCMTX on the open market, which could bring a wave of liquidity to the token.

With innovative features, a high-performing presale, and a stellar roadmap, Bitcoin Minetrix represents an intriguing BTC alternative worth watching amid the market volatility.

Visit Bitcoin Minetrix Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Bitcoin Price Crash, Buy The Dip Or Sell – This BTC Alternative Raises $5 Million In ICO appeared first on CryptoPotato.