Bitcoin’s price has finally created a new higher high, following weeks of consolidation and correction. This has caused many investors to believe that a new all-time high will be created in the upcoming months.

Technical Analysis

By TradingRage

The Daily Chart

On the daily chart, the price has broken above the key $48K resistance level after a previous rejection. Bitcoin is currently targeting the $52K resistance level in the short term.

Meanwhile, the Relative Strength Index is demonstrating a clear overbought signal that hints at a possible correction in the near term. Yet, with the $48K area turning into a support level, it seems unlikely that the market will decline deeply.

The 4-Hour Chart

Looking at the 4-hour timeframe, the price has been rising almost vertically, breaking past multiple resistance levels with ease. BTC is currently traded above the $48K level, but the $50K psychological resistance has seemingly rejected the price.

It is probable for the market to retest the broken $48K level in the short term before a continuation toward the $52K resistance zone.

On-Chain Analysis

By TradingRage

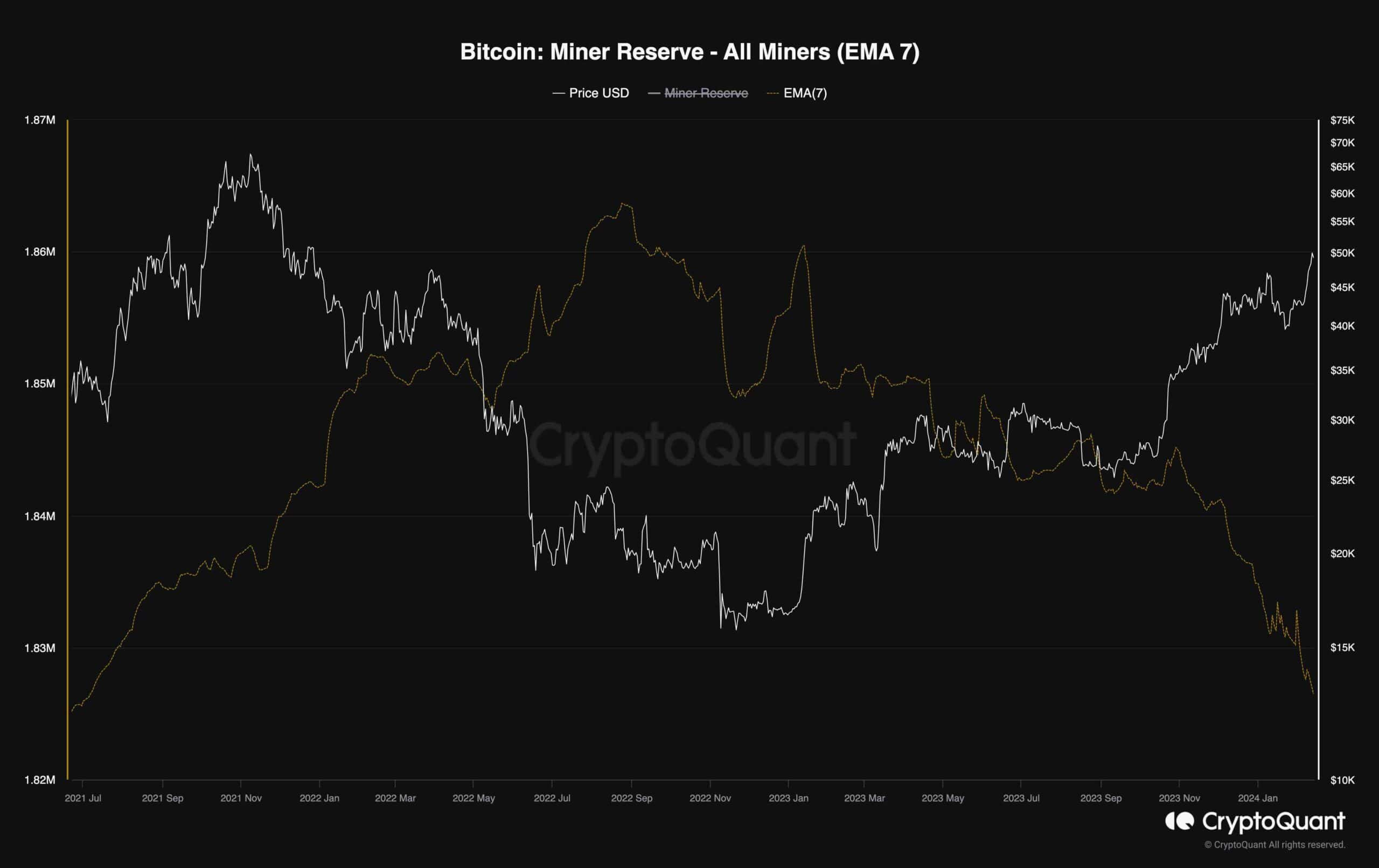

Bitcoin Miner Reserve

While Bitcoin’s price has been rising rapidly, not all market participants are optimistic about the future. The miners are seemingly one of these cohorts.

This chart demonstrates the Bitcoin miner reserve metric, which measures the amount of BTC held in miners’ wallets. Increases in the miner reserve indicate accumulation, while declines suggest that the miners are offloading their coins.

As demonstrated on the chart, the miner reserve metric has been falling aggressively amid the price’s recent rally. It seems that the miners are using the increase in demand to realize profits on their coins. While this is a natural behavior in bullish markets, the resulting selling pressure might lead to a bearish reversal if the counterparty demand shrinks.

The post Will BTC Soar to an All-Time High in February Following 13% Weekly Push? (Bitcoin Price Analysis) appeared first on CryptoPotato.