Bitcoin’s price movements have calmed over the past day after skyrocketing to $72,000, and the asset has even lost some ground since yesterday, currently sitting below $70,000.

Ethereum continues to present a strong front as anticipation builds for today’s SEC decision on one of the ETH ETFs.

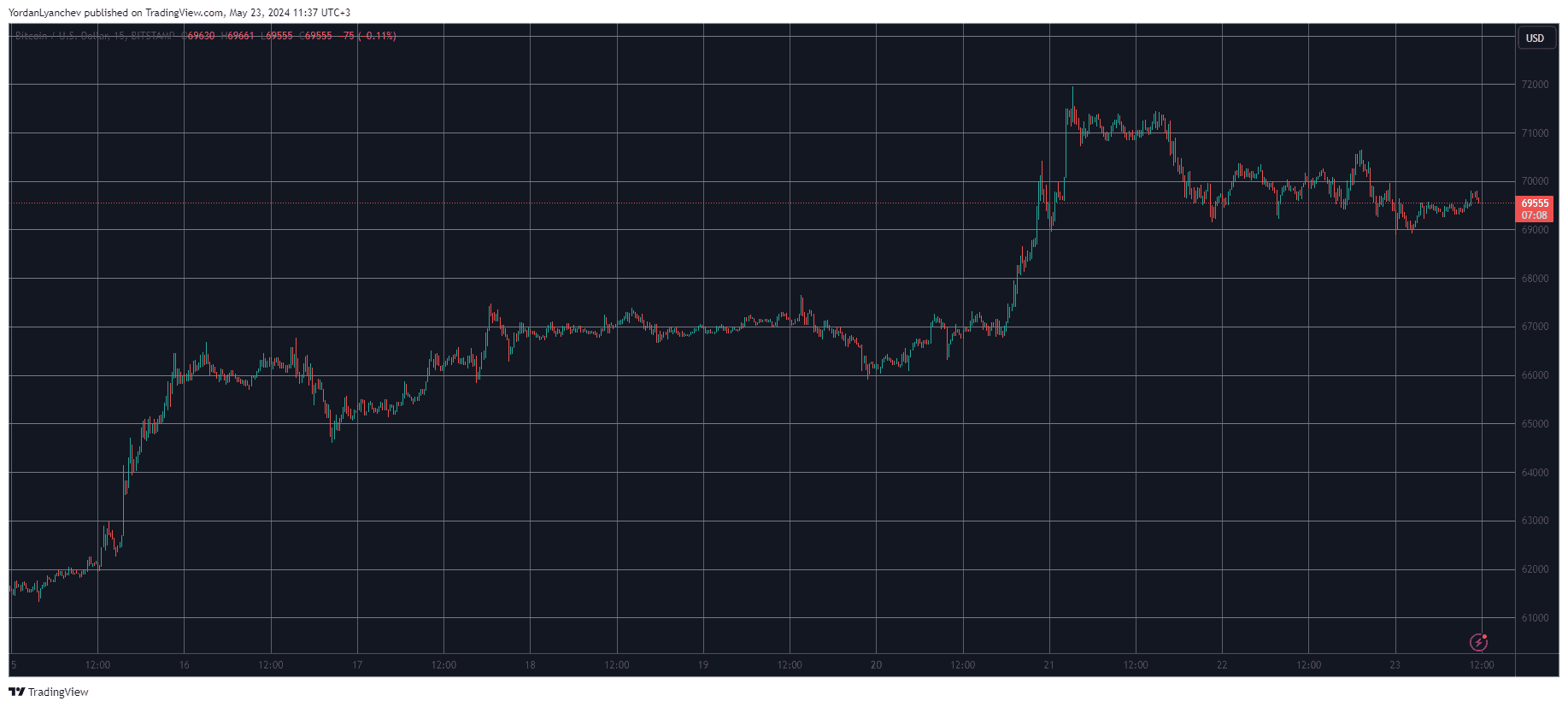

BTC Slips Beneath $70K

Bitcoin had a quiet weekend, which it spent trading sideways, around $67,000, as the consolidation continued. However, the landscape changed substantially on Monday evening when news emerged that the US Securities and Exchange Commission could greenlight a spot Ethereum ETF as early as this week.

The primary cryptocurrency reacted quite positively to the reports and soared past $70,000 for the first time in over a month and tapped a 6-week peak of just shy of $72,000.

The bears finally stepped up at this point and didn’t allow the asset to challenge its March 2024 high of $73,750. Instead, BTC started losing value gradually by dropping to $70,000 yesterday and below that level today.

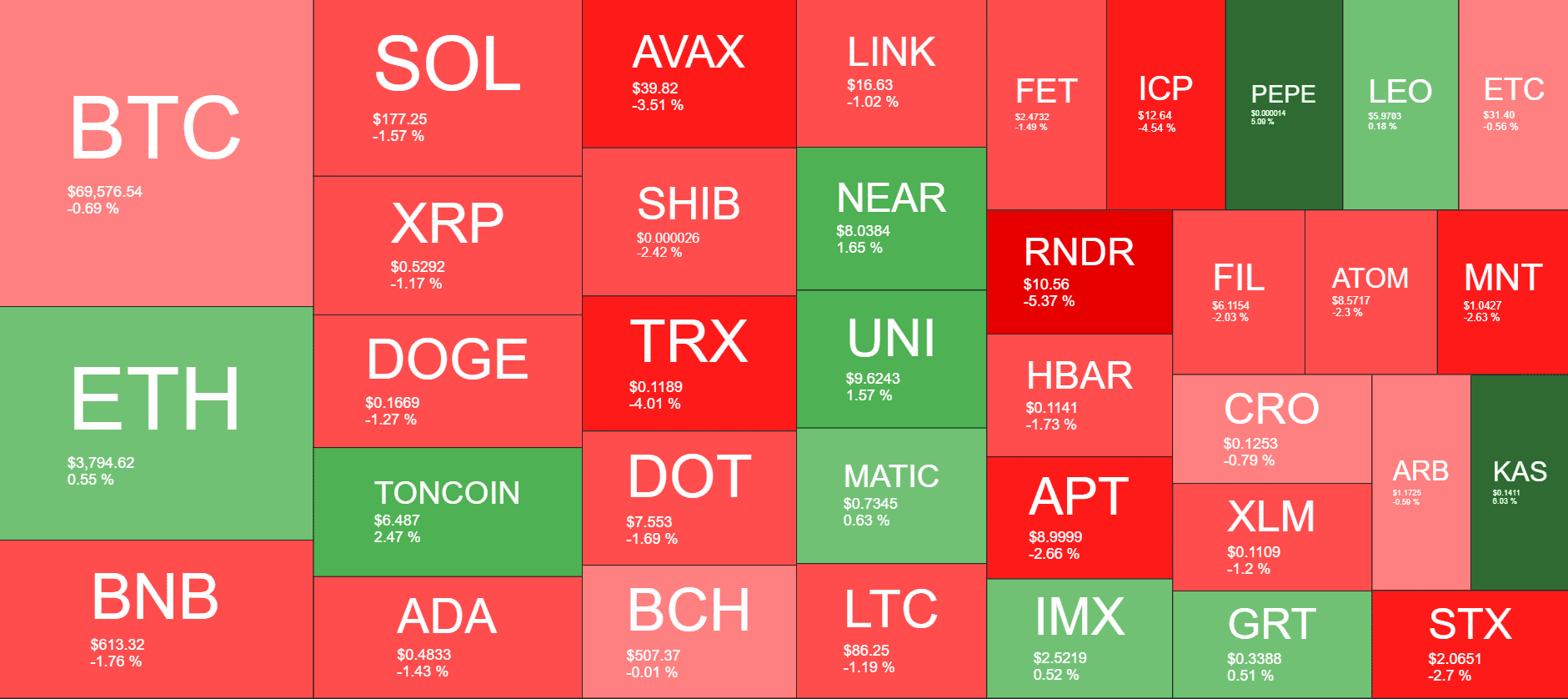

As of now, the cryptocurrency trades about $500 away from the round-numbered milestone, with its market cap down to $1.370 trillion. Its dominance over the alts has retraced by more than 1% in the past several days and is now at 50.3% on CG.

ETH Remains Above $3.8K

The positive news mentioned above impacted ETH the most, as expected. The underlying asset exploded by over 20% in a matter of hours and tapped a multi-week high of its own at over $3,800. With the decision looming in today on the SEC’s decision on one of the applications today, ETH’s price has remained steady at around $3,800.

TON and NEAR are the other larger-cap alts in the green today, while SOL, BNB, ADA, DOGE, AVAX, XRP, and SHIB have turned red.

PEPE has been on the run lately, charting new all-time peaks frequently, and today was no different.

The total crypto market cap has remained relatively still at just under $2.730 trillion.

The post ETH Maintains $3.8K Price Ahead of SEC ETF Decision, BTC Slips Below $70K (Market Watch) appeared first on CryptoPotato.