Solana (SOL) has been on a rollercoaster ride of late, with its its value seeing erratic shifts and even retreating in many instances.

For Solana, the sharp swings in the market have presented a difficult picture; nevertheless, experts still have optimism. They see this as a passing phase even with the downward pressures. The altcoin’s technical developments point to an interesting future.

At the time of writing, SOL was trading at $150, down 6.2% and 17.1% in the daily and weekly frames, data from Coingecko shows.

Even within the turmoil, the recent trading volume of $9.80 billion over the past 24 hours demonstrates a notable degree of activity and investor interest.

Technical Indicators And Bullish Patterns

Ali Martinez, a famous crypto analyst, recently talked about Solana’s possible return, which makes dealers and buyers very interested.

Martinez’s study indicates on Solana’s 4-hour chart a bullish megaphone pattern developing. This trend, which shows growing volatility, usually comes before significant price increases.

I know, the dip keeps dipping!

However, #Solana might be forming a bullish megaphone on the 4-hour chart. The recent correction to the 61.8% Fibonacci level and oversold RSI suggest it could be a good time to buy $SOL.

Consider placing your stop-loss around $156-$154 and… pic.twitter.com/ylnaPAf2EV

— Ali (@ali_charts) August 1, 2024

One of the main signs that could validate Solana’s positive outlook is the digital asset’s adaptation to the 61.8% Fibonacci retracing level. Highly important in technical analysis, the Fibonacci retrace aids in the estimation of probable support and resistance levels. Especially the said level is viewed as a tipping point when normal market fluctuations are expected.

To reduce risk, Martinez recommends establishing a stop-loss order between $156 and $154, therefore guaranteeing that, should the price fall to this predefined level, holdings are instantly liquidated. This approach seeks to minimize possible losses and set investors to profit from the anticipated increasing trend.

Conversely, Martinez’s take-profit objective is from $200 to $259, therefore providing a significant profit margin for those ready to negotiate the present dynamics of the market with measured risks.

Long-Term Prospects And Strategic Positioning

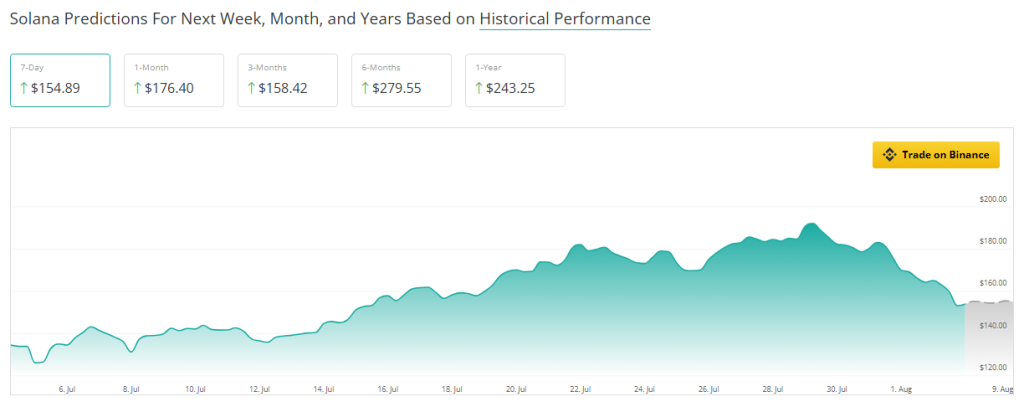

Although the market for cryptocurrencies is inherently volatile, Solana’s long-term prospects are very bright. SOL is selling at a 14.59% discount to its expected estimate for the next month based on data from the crypto prediction tool CoinCheckup. This underperformance points to possible undervaluation, thereby offering investors ready for a comeback a window of opportunity.

From what CoinCheckup can tell, prices will go up by 2.91 percent over the next three months. This is the start of a healing time. Even though this projected rise is small, it sets the stage for bigger ones.

Things are looking up for Solana: prediction data show it is poised to rally 80% over the next six months. This projection is probably based on the notion that the network will improve, more people will use it, and the market will be growing.

Featured image from Chainalysis, chart from TradingView