Bitcoin fell sharply over the past week, sliding almost 15% and moving beneath the $100,000 and $95,000 marks to trade around $90,300, Wednesday.

According to company disclosures, Michael Saylor’s Strategy bought an extra 8,178 BTC for $835.6 million at about $102,171 apiece during the downturn. That move has drawn fresh attention because some of those newest coins are already underwater.

Strategy’s Holdings And Recent Buys

Reports have disclosed that Strategy now holds 649,870 BTC, equal to roughly 3.2% of the circulating supply. The firm says it paid about $48 billion for those coins. At current prices, the holding’s market value sits near $59.38 billion, leaving an overall paper gain of 22% or about $11 billion.

Strategy has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK https://t.co/HI1TeYOvQ9

— Michael Saylor (@saylor) November 17, 2025

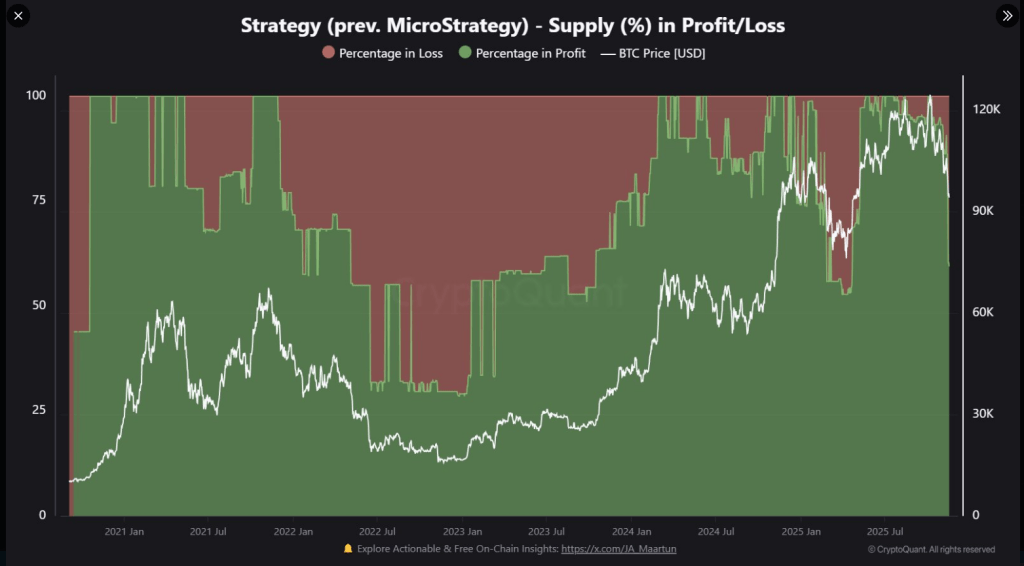

Yet CryptoQuant’s breakdown finds that roughly 40% of Strategy’s stash is now showing unrealized losses, a result of the company’s recent buying activity pushing newer lots above today’s market price.

The newest 8,178 BTC purchase is already down around 10.5%, costing the company roughly $88 million on paper in a matter of days.

Reports also show Strategy made three separate buys earlier this month: smaller blocks recorded on the third and the 10th of November, bringing November’s total to 9,062 BTC for $931.1 million. At current market levels those November tokens are worth about $827 million, a drop of just over 11% since the buys.

Saylor’s Portfolio Turns Red?

He announced the purchase of 8,178 BTC at an average price of $102,171, about 10% above current market levels.

This recent bitcoin move puts ~40% of Strategy’s 649,870 BTC holdings in the red, with only 60% still in profit. pic.twitter.com/hii0BmV95P

— CryptoQuant.com (@cryptoquant_com) November 18, 2025

Short-Term Losses Amid Long-Term Gains

While parts of the position sit in the red, Strategy’s longer-term position remains positive. The company’s overall profit ratio of 22% is well above the deep losses it faced from mid-2022 into early 2023, when as much as 75% of its holdings were showing losses and the portfolio was down about 33%, equal to roughly $1.32 billion in paper losses then.

Early last month Strategy had a peak profit ratio near 68% with gains calculated at about $32 billion, showing how swings can be large on both sides.

According to filings, Saylor treats dips as chances to add coins, and this latest buying fits that pattern. Not every market participant agrees.

A Fraud?

Peter Schiff, a well-known gold investor, criticized Strategy’s rising average cost, which he says—at about $74,433 per BTC—has been moving closer to the market value and could limit upside if prices fail to rebound.

Schiff said on Sunday that Strategy Inc.’s focus only on Bitcoin is “a fraud.” He also challenged Michael Saylor to a live debate at Binance Blockchain Week in Dubai this December.

Schiff argued that the company’s recent gains mainly come from the rising Bitcoin price. He warned that if people lose confidence in Bitcoin, the company’s finances could be in trouble.

What This Means For Investors

For outside observers, the takeaway is straightforward: even the biggest holders can have portions of their inventory in loss when markets fall.

Strategy’s newer purchases have reduced the firm’s tidy headline returns, but they did not wipe out the overall gain. Reports suggest the company is still sitting on a sizable paper profit.

Short-term results for those November buys look poor. Long-term results will depend on future price moves.

Featured image from Gemini, chart from TradingView