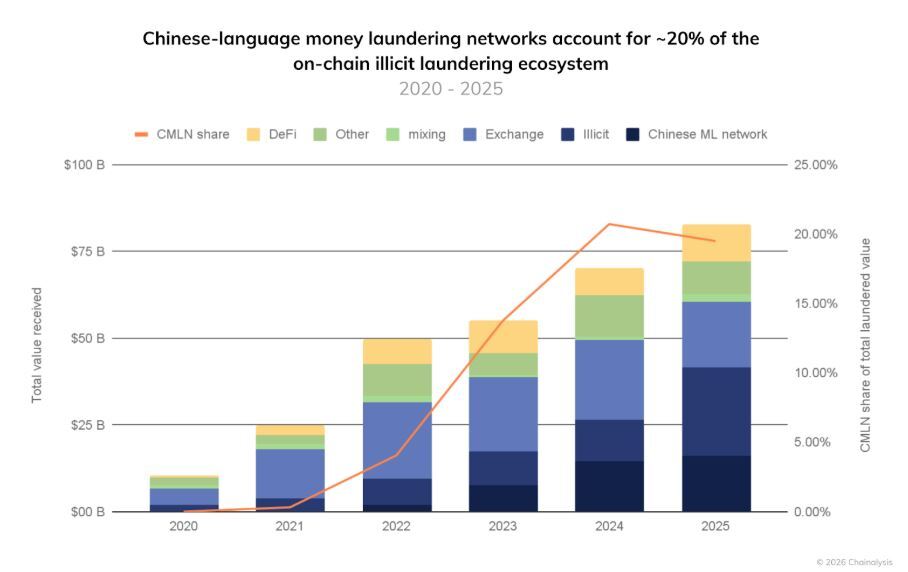

The illicit on-chain money laundering ecosystem has expanded sharply over the past five years and has grown from just $10 billion in 2020 to more than $82 billion in 2025, according to blockchain analytics firm Chainalysis.

This surge was attributed to the rising accessibility and liquidity of cryptocurrencies, in addition to a major change in how laundering activity is carried out and which actors are involved.

CMLN Inflows

In fact, data show that Chinese-language money laundering networks (CMLNs) have significantly increased their role. They now account for roughly 20% of known illicit laundering activity in 2025.

In a report shared with CryptoPotato, Chainalysis revealed Chinese-language money laundering networks now consistently launder more than 10% of funds stolen through so-called pig butchering scams. Interestingly, this trend has coincided with a steady decline in the use of centralized exchanges, which are more likely to freeze illicit funds.

Since 2020, inflows to identified CMLNs have grown at a far faster pace than other laundering endpoints, with figures increasing 7,325 times faster than inflows to centralized exchanges, 1,810 times faster than decentralized finance (DeFi) protocols, and 2,190 times faster than intra-illicit on-chain transfers.

While Chainalysis stated that CMLNs are not the only facilitators of on-chain laundering, Chinese-language, Telegram-based services also represent a disproportionate share of the global on-chain laundering landscape. These services process proceeds linked to a wide range of on-chain and off-chain criminal activity.

The blockchain firm has identified six distinct service types that together form the CMLN ecosystem, which collectively processed $16.1 billion in inflows in 2025. The number of active entities within these networks has expanded rapidly, and has even risen from a small group just a few years ago to more than 1,799 active on-chain wallets in 2025.

Chainalysis also said that the time required for each service type to process $1 billion from the first known address in its category points to both rapid growth and major differences across service types. On-chain transaction data further indicates that financial flows through CMLNs closely mirror the classic smurfing and aggregation phases associated with traditional money laundering operations.

Russian-Language CLN

While CMLNs play a significant role in crypto-based money laundering, Chainalysis stated they are not the only networks adapting to new technologies. In December 2024, the United Kingdom’s National Crime Agency dismantled a multi-billion-dollar Russian-language laundering operation that catered to cybercriminals, drug gangs, and both Russian and international elites.

Tom Keatinge, Director at Centre for Finance & Security (CFS) at RUSI, was quoted as saying,

“There is a chasm in most countries between the capabilities of criminals and law enforcement when it comes to crypto use. A combination of nationally-based laws, barriers created by borders, poor information sharing, and limited crypto tracing and asset recovery capabilities means that crypto offers criminals a low risk/high reward method of benefiting from their criminality.”

The post Chinese-Language Laundering Networks Now Dominate a Fifth of Global Illicit Crypto Flows appeared first on CryptoPotato.