Which DeFi apps will rock our world in 2022? Let’s find out!

DeFi (Decentralized Finance) is one of the biggest trends in the blockchain industry, and many believe it will overtake the traditional finance world. While the current financial system works on a centralized platform, controlled by government agencies and other intermediaries, DeFi operates according to a protocol that runs on a decentralized network powered by blockchain.

The massive adoption of DeFi became evident in 2021 when the DeFi investments surpassed $100 billion. Experts believe this growth will be exponential thanks to DeFi financial products like efficient stablecoin trading, DeFi lending or Yield Farming, DEX (Decentralized exchanges), and DeFi insurance.

Read on to learn everything you need to know about the DeFi space, popular DeFi protocols, and the top 10 DeFi apps in 2022 that allow users to lend, borrow, trade, and invest their crypto assets.

Let’s dive in!

What Is DeFi

DeFi, a short-term for Decentralized Finance, involves financial services based on blockchain technology. The DeFi concept is new, but it allows millions of people who don’t have access to traditional financial systems (for various reasons, globally, more than 1,700 million people don’t have a bank account) to be in control of their finances, promoting financial freedom and unprecedented economic growth.

DeFi eliminates the need for central banks, financial institutions, and other third parties. This means users can conduct financial transactions in minutes or seconds through decentralized finance applications without the fees that banks and other financial companies charge for using their services.

Financial transactions on DeFi apps (DApps) are carried out through P2P (peer-to-peer) financial networks that use security protocols, connectivity, software, and hardware advancements. Anyone with an internet connection can trade digital assets, lend, and borrow crypto using software that records and verifies financial actions in distributed financial databases.

DApps function on smart contracts, which are used to execute transactions and create scarce assets with specialized functionalities. Many of the clauses of traditional commercial agreements could be transferred to a smart contract. Smart contracts go beyond finance and are applied in video games which allow you to create, explore, and trade in a Metaverse.

Ethereum is the foundation for the majority of DApps. Today, 214 of 238 DeFi projects in the world run on the Ethereum Ecosystem. Other cryptos offering smart contracts include Solana, Polkadot, Algorand, Cardano, Terra (LUNA), etc.

Why DeFi Is Important in Crypto

Traditional Finance often involves long transaction processes, monitoring, and multiple service fees. Regulations from government agencies and fintech owners often cause traditional or centralized finance problems.

Consider how you obtain a loan in traditional finance. You’d have to request it from your financial institution or another middleman. If you’re authorized, you’ll have to pay tax and processing fees to use the lender’s facilities.

Defi users are free from these restrictions, as thanks to blockchain technology, no one controls the DeFi platform. DeFi lending platforms employ smart contracts to eliminate the need for middlemen such as banks to manage lending.

A DeFi application is essential as:

- It eliminates the fees charged by financial companies for utilizing their services.

- It helps you save your cash in a secure virtual wallet instead of keeping it in banks.

- Anyone with an internet connection can use it without needing permission.

- It allows you to carry out transactions faster.

Difference Between DeFi Coins and DApps

If you are new to the DeFi system, you may quickly get confused with these two terms: DApps and DeFi Coins.

DApps or decentralized applications are software applications similar to traditional ones, except they work on Smart Contracts platforms. The main advantages are these open-source apps operate outside of the administration and jurisdiction of a central agency. DApps function on a network of computers using blockchain P2P technology and can be used by anyone with internet access.

DApps are built for different applications like finance, gaming, banking, NFTs, and social networking sites. As a content creator, you can easily earn virtual money using DApps, similar to YouTube or Twitter.

What Are Defi Coins

DeFi coins (also known as DeFi tokens) are digital currencies that can be purchased, sold, and exchanged utilizing DApps.

DeFi coins are created in an open-source ecosystem using censorship-resistant adaptable platforms. Some tokens are pegged to the value of a currency like the US dollar. Other DeFi coins fluctuate depending on market forces like stocks or rebase themselves automatically in response to market variations.

Generally, you don’t have to provide private information to access DeFi coins on DApps. With smart contracts used in DApps, you can maintain anonymity while buying and selling DeFi coins.

Top 10 DeFi Apps in 2022

Let’s look into the best DApps that have stood the test of time and have a large user base and other advantages. The first thing most rankings consider is TVL, the total value locked (TVL). However, this can be misleading as many DeFi projects quickly raise a lot of money, only to have their consumers abandon the platform for another one.

In digital currency, TVL refers to the total value of assets locked within these DApps – the higher the value locked up in a DApp, the better. Knowing the total value locked within a DApp may be used to estimate the state of the yield farming environment.

However, TVL is not the only important feature of a DeFi app to consider, and you should also check out the longevity and how the platform sustains its users.

Here are some DeFi apps that have stood the test of time.

List of Top DeFi Apps

AAVE

Performance Score: 9.5/10

Total Value Locked: $11 billion

Pros

- Huge lending pool available for various digital assets.

- More features for lenders and borrowers of digital assets.

- Stable interest rates for some digital currencies.

- Users can take flash loans with KYC registration.

Cons

- Complex and not user-friendly.

- Low incentives for lenders and borrowers using the platform.

- The flash loans option is susceptible to the manipulations of hackers.

The Aave protocol functions on an open-source framework that gives lenders and borrowers complete control over their crypto assets. Aave was primarily designed for lending and borrowing digital assets and cryptocurrencies. However, it has become a household brand among cryptocurrency enthusiasts and blockchain professionals thanks to its high market capitalization, large liquidity pools, stable interest rates, huge lending pools for various crypto assets, collateralized loans, etc.

General Information:

· Stani Kulechov is the founder of Aave.

· The DApp was created in 2017.

· It was formerly named ETHLend.

· Aave runs on the Ethereum blockchain.

· Aave Twitter community consists of 408,000 followers.

Key Features:

· Collateralized infinite loans with zero borrow interest rates.

· Flash loans or non-collateralized loans with a fixed interest rate of 0.09%.

· Access loans in different virtual currencies.

· Flexible interest rate for borrowers.

Why We Recommend: Aave is a fantastic protocol for experienced users with unique features and functionality. It’s an excellent choice for individuals interested in crypto-based borrowing and lending due to its rapid and straightforward lending process.

MAKER

Performance Score: 9.0/10

Total Value Locked: $17 billion

Pros

- More than 400 applications and exchanges currently use Maker.

- Maker’s token DAI is stable since it’s pegged to the value of the US Dollar.

- It operates an open and transparent system.

- You can earn interest or DAI Savings Rate (DSR) by locking your assets in Maker’s DAI.

- It offers stability, flexibility, and security.

Cons

- It’s prone to malicious hack attacks against smart-contract infrastructure.

- Black Swan events (A black swan risk refers to the possibility of the occurrence of an unexpected event) often lead to major losses, i.e., check out the events on March 12, 2020.

MakerDAO is an open-source project based on the Ethereum blockchain. The collateralized lending protocol has had 14,954 users to date and is the fifth largest app in the DeFi ecosystem. It’s a decentralized autonomous organization (DAO), powered by its native token, MKR, and the stablecoin DAI. Maker enables users to generate DAI by leveraging collateral assets approved by “Maker Governance.” You can lend or borrow money in DAI stablecoin if you have a Metamask or ETH wallet.

General Information:

· Rune Christensen is the founder of Maker.

· The development of MakerDAO started in 2015, but it was available for use in 2018.

· Maker is built on the Ethereum blockchain.

· Maker DApp provides lending/borrowing services and stability in trading.

Key Features:

· MakerDAO offers two cryptocurrencies: DAI and MKR.

· The stablecoin known as DAI is pegged to the Dollar, while the MKR token is used to pay interest to users.

· Maker is mainly used for lending of the stablecoin, DAI. Users deposit supported ETH into the Maker Vault, generating a loan represented in DAI, which can subsequently accrue interest.

Why We Recommend: MakerDAO’s tokens, DAI and MKR, function together to offer investors significant rewards and revenue. MakerDAO offers token holders the ability to collateralize a range of digital asset holdings in return for stablecoin loans paid in DAI and managed through a system called “Collateralized Debt Positions” (CDPs).

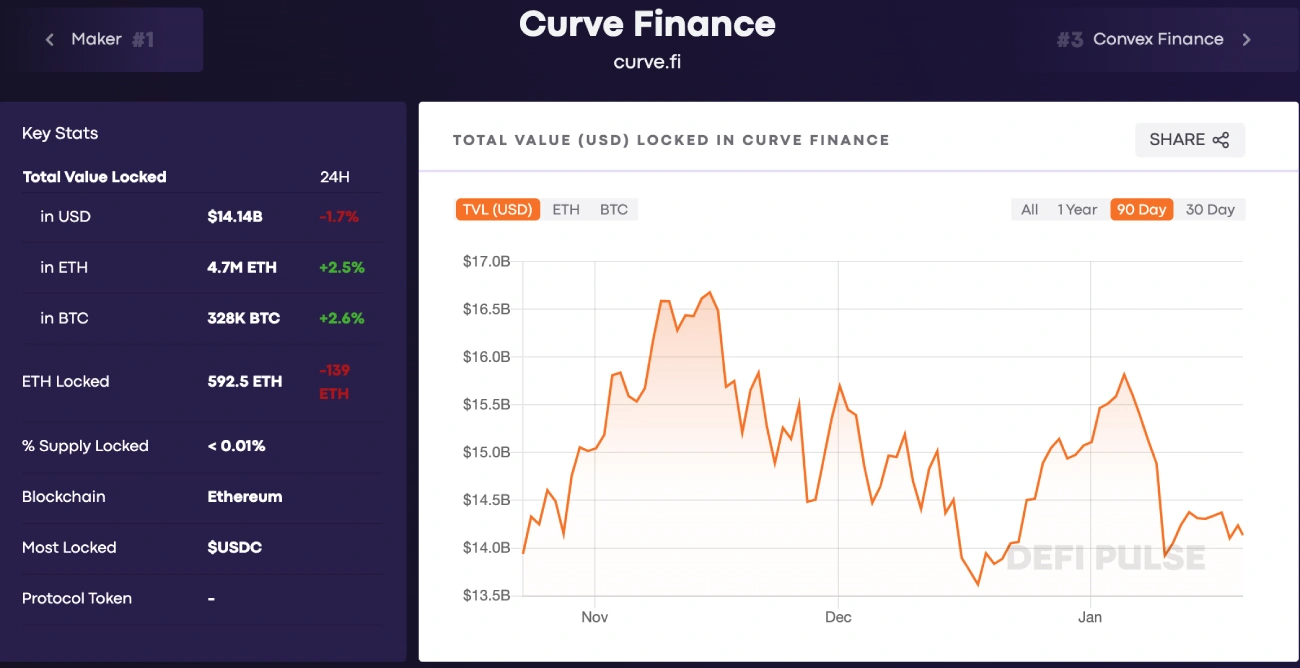

Curve Finance

Performance Score: 9.0/10

Total Value Locked: $14 billion

Pros

- Low transactional fees.

- Curve can prevent price differences in crypto pairs, which is accomplished by allowing for new types of bonding curves.

- Reduced risk of impermanent loss. Curve’s liquidity brokers offer stablecoin pairings that reduce impermanent loss to a minimum.

Cons

- Most investors avoid Curve’s token due to its sophistication.

- The risk from separate DeFi protocols. Curve Finance integrates with multiple DeFi protocols, making the system vulnerable to issues arising from a separate DeFi system.

- High fluctuation in liquidity returns. Liquidity pools returning a high annual percentage yield (APY) can often reduce to a low APY over time.

Curve Finance is an Ethereum-based open-source exchange protocol on which users can swap and trade Ethereum-based assets. Curve Finance also provides liquidity to the markets using a market-making algorithm that automatically buys and sells assets while profiting from the bid and ask price spreads. Curve Finance enables high stablecoin transactions and low-risk rewards for market makers.

General Information:

· Michael Egorov is the founder of Curve Finance.

· The Curve Finance DAO’s ERC-20 token, CRV, is a governance token.

· Curve Finance has 251,000 followers on Twitter.

· Curve is both a Decentralized Exchange and DeFi lending platform.

Key Features:

· Vote-escrowed CRV (veCRV) is a term for CRV that has been secured into the Curve protocol for a set period.

· Owners of veCRV often earn profit from transaction fees.

· If you deposit the coin with the smallest ownership in a liquidity pool, a deposit incentive may be provided.

Why We Recommend: Curve provides a loan mechanism with low volatility compared to other DEXs. Curve Finance also rewards users that provide liquidity to the exchange. Liquidity pools don’t match a buyer with a seller to complete an exchange, resulting in a more efficient transaction.

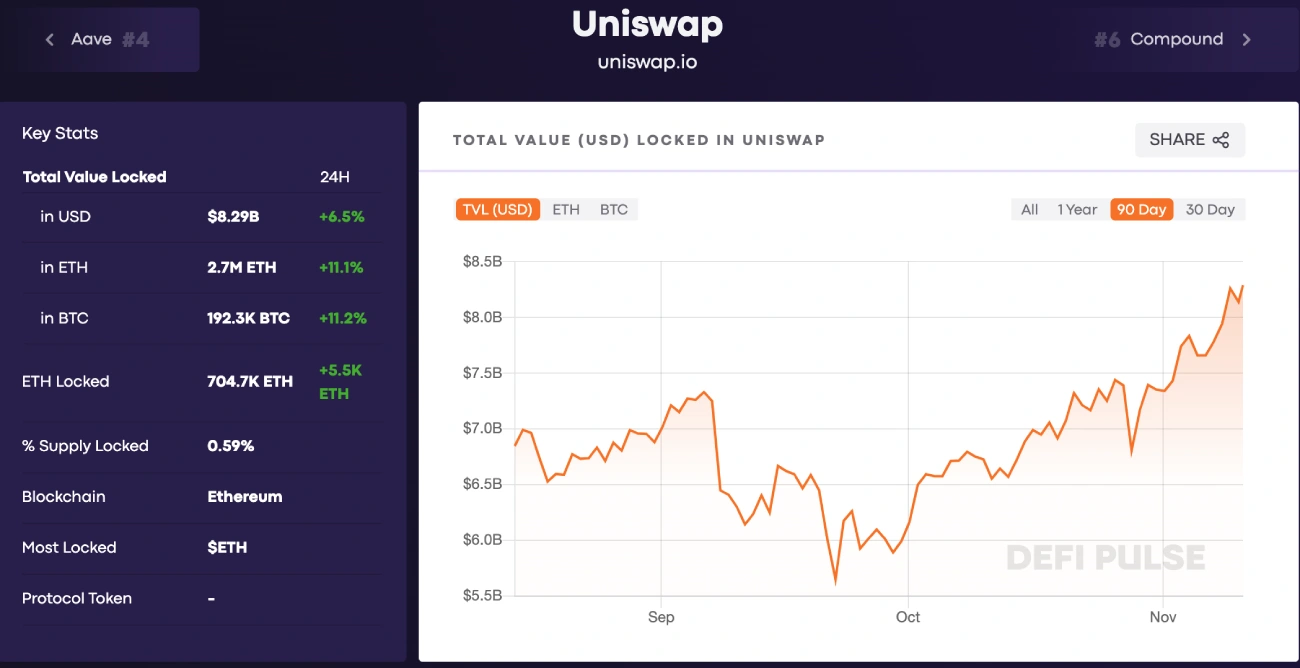

UniSwap

Performance Score: 8.5/10

Total Value Locked: $8 billion

Pros

- Swapping a wide range of ERC-20 tokens is possible.

- Straightforward and user-friendly.

- Full transparency and an open-source code.

- You can earn rewards by staking your digital currencies.

- Your crypto wallet is all you need to get started.

- KYC registration and other personal details are not required to set up an account.

Cons

- You can’t use fiat currency to make transactions on Uniswap.

- Ethereum fees. Uniswap operates on Ethereum, which as of May 2021, is plagued with high gas (transaction) fees.

- Investors often experience impermanent losses when staking on Uniswap.

Uniswap is a fully decentralized protocol and one of the largest crypto exchanges operating on the Ethereum blockchain. The DApp offers an entirely self-regulated, decentralized environment where users maintain total control over their funds, unlike a centralized exchange which makes users give up their private keys. As such, no single business can own, manage, or govern its platform. Uniswap employs an autonomous liquidity system, a relatively new trading mechanism that eliminates the need for certified intermediaries while prioritizing scalability and security.

General Information:

· Hayden Adams is the founder of Uniswap.

· Uniswap serves as a decentralized exchange platform (DEX).

· Uniswap was launched in 2018.

· The Twitter community of Uniswap includes 718,000 followers.

Key Features:

· UNI, Uniswaps’ original coin, is a governance token, so owners can participate in decisions on how the platform is run.

· Customers may make money by supplying liquidity using Uniswap’s Pool.

Why We Recommend: Uniswap provides a wide range of services and features and allows you to trade via the DEX to exchange tokens. You can also earn interest on your crypto holdings through Uniswap’s liquidity pools.

Compound

Performance Score: 8.0/10

Total Value Locked: $8 billion

Pros

- Higher interest rates compared to traditional financial institutions.

- You don’t need AML, KYC, or Credit Score to use the platform.

- The Compound (COMP) tokens are used to reward customers.

- There are no restrictions on using the asset pool several times.

- It’s a Decentralized Autonomous Organization that is governed by Community.

Cons

- A limited number of cryptocurrencies to borrow or lend.

- A highly volatile algorithm-based smart contract system leads to technical errors in the DeFi system.

- Yield Farming can be risky as the users can trade crypto much larger than the actual value they have put down.

Compound is an Ethereum-based algorithmic financial market protocol that allows users to earn interest and borrow crypto assets against collateral. Anyone may contribute securities to Compound’s liquidity reserve and start earning interest right away. Automatic rate adjustments according to the market dynamics.

General Information:

· Robert Leshner is the founder of the Compound protocol.

· Compound was launched in 2018.

· The DApp provides a stablecoin and a platform for lending/borrowing digital assets.

· The number of followers in Compound’s Twitter community is more than 213,000.

Key Features:

· The Compound smart contract allocates 10% of interest payments as reserves, with the remaining funds going to providers.

· cTokens are representations of the financial commodity that generate interest and act as security for supplied asset amounts.

· Based on the asset class value, customers can borrow between 50% and 75% of the price of their cTokens.

Why We Recommend: Compound has been a vital actor in modernizing the old finance system through smart contract technology, one of the most user-friendly, secure, and open DeFi technologies available. The number of supported crypto-assets may grow over time.

Convex Finance

Performance Score: 8.0/10

Total Value Locked: $12 billion

Pros

- It’s easy to stake your crypto assets straight from the Convex Finance website.

- The web interface is straightforward and intuitive.

Cons

- You cannot purchase CVX directly with the US Dollar or any fiat currency.

Convex is a decentralized application developed on Curve that allows liquidity providers and CRV stakers to earn better returns. Convex finance uses the Ethereum blockchain, so to engage with the DeFi platform, you’ll need Ethereum wallets like Metamask. You can also use the CoinStats wallet, which lets you manage all your DeFi and crypto from one place – a single wallet to buy, sell, swap, track, and earn on your crypto.

General Information:

· Ricardo Rosales is the founder of Convex Finance.

· Convex’s DeFi protocol uses Ethereum blockchain technology.

Convex’s Twitter community has more than 30,000 followers.

Key Features:

· Convex Finance rewards curve liquidity suppliers.

· Convex Finance’s original framework coin is CVX.

· CVX can be used to receive a portion of Curve LP’s CRV profits through Convex Finance.

· Convex has a transaction charge of 16 percent of CRV income, and convex customers are solely responsible for these costs.

· The overall availability of CVX coins is 100 million.

Why We Recommend: Since Convex is entirely symbiotic to Curve and magnifies Curve’s effectiveness, Convex will achieve by orders of magnitude if Curve continues to succeed. Essentially, everyone using Convex is pooling their assets together so the platform can acquire more CRV, convert it into veCRV, then maximize boost to all Curve LP token holders.

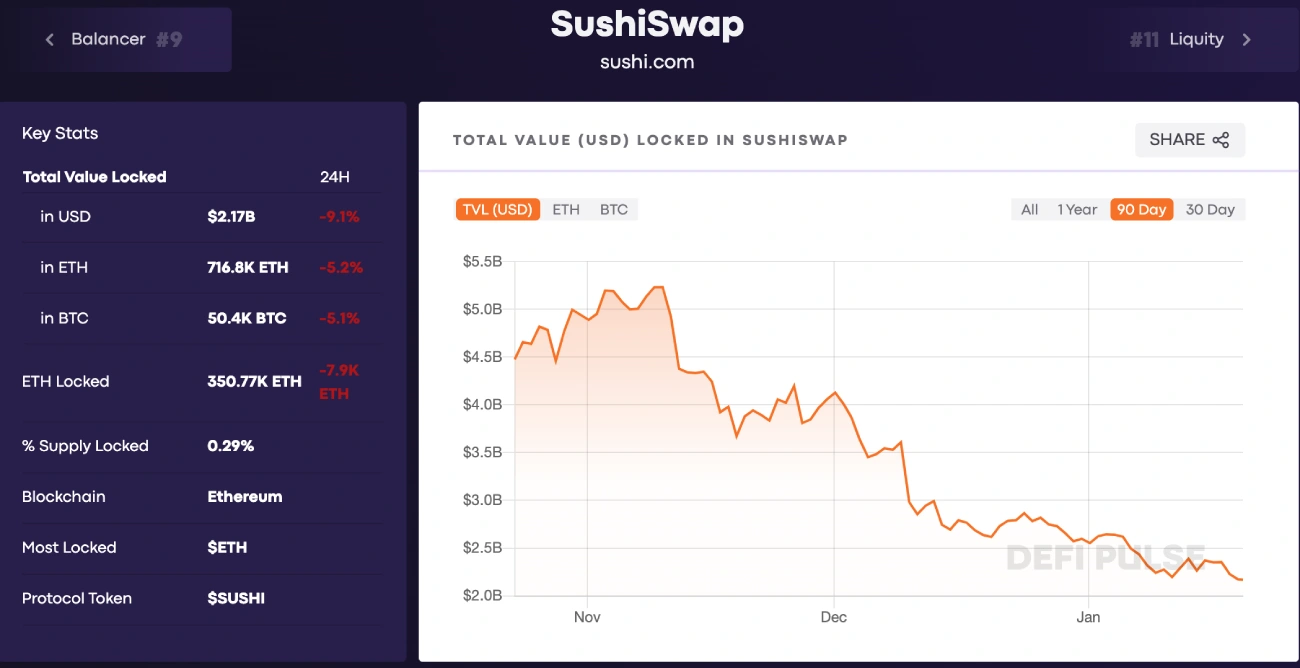

SushiSwap

Performance Score: 7.5/10

Total Value Locked: $2 billion

Pros

- Over 100 ERC20 trading pairs are available.

- Users can swap, stake, farm on the SUSHI-based projects.

- Easy to navigate and use.

Cons

- Lower % fees earned than on Uniswap.

- High gas fees (a problem that all other Ethereum AMMs face).

- Danger of impermanent loss.

- Various internal issues.

SushiSwap leverages global liquidity pools to create unique markets for any pair of assets and uses an automated liquidity protocol as its trading model. The SushiSwap Token (SUSHI) governs the decentralized exchange and rewards those providing liquidity to the pools. SushiSwap uses Automated Market Makers (AMM) to facilitate trades, using smart contracts to generate and manage liquidity pools. It aspires to be a refinement of Uniswap, the popularly used Ethereum-based decentralized exchange, and the most notable difference is the ability to yield farm on SushiSwap.

General Information:

· Chef Nomi and 0xMaki are founders of Sushiswap. Both names are pseudonyms of the actual unknown inventors.

· Sushiswap was introduced in August 2020.

Key Features:

· Users may effortlessly trade within the range of 100 ERC-20 tokens on SushiSwap.

· SushiSwap charges 0.3% in trading fees.

· You can use the SushiSwap’s Menu to find former yield farming pools.

· Traders can stake SUSHI tokens at SushiSwap’s Sushi Bar to gain more SUSHI tokens. Holders of SUSHI can participate in community governance and stake their tokens to receive a portion of SushiSwap’s transaction fees.

Why We Recommend: The key benefits are that you can use SushiSwap to farm and earn a high annual interest rate, grant, and borrow assets against collateral. While the code is a copy from Uniswap, the SushiSwap team continues to add new features and compatibility with multiple blockchains that Uniswap doesn’t offer.

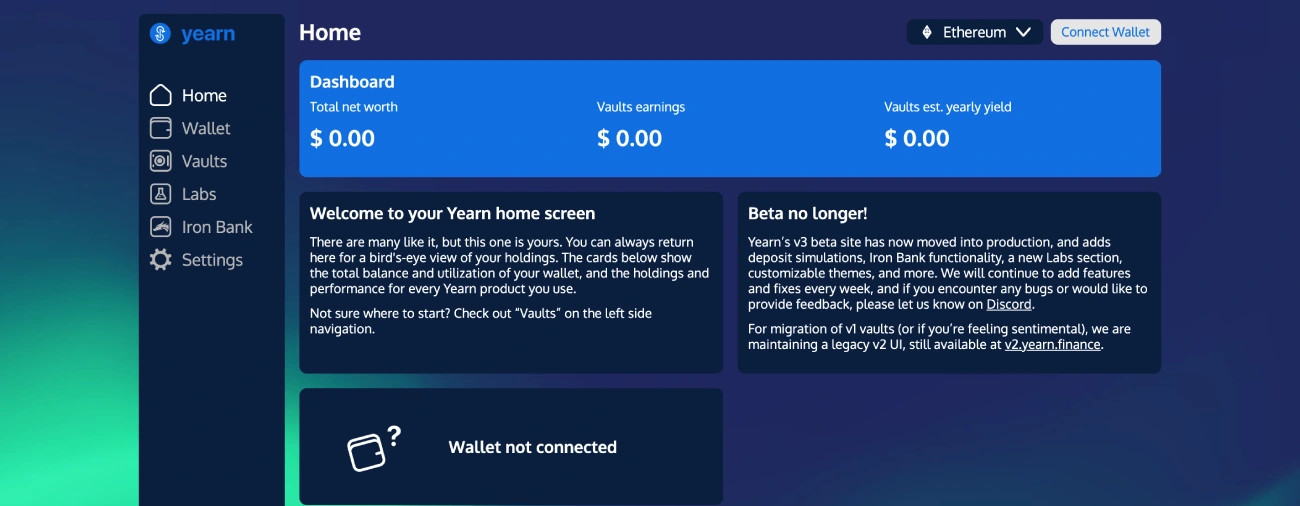

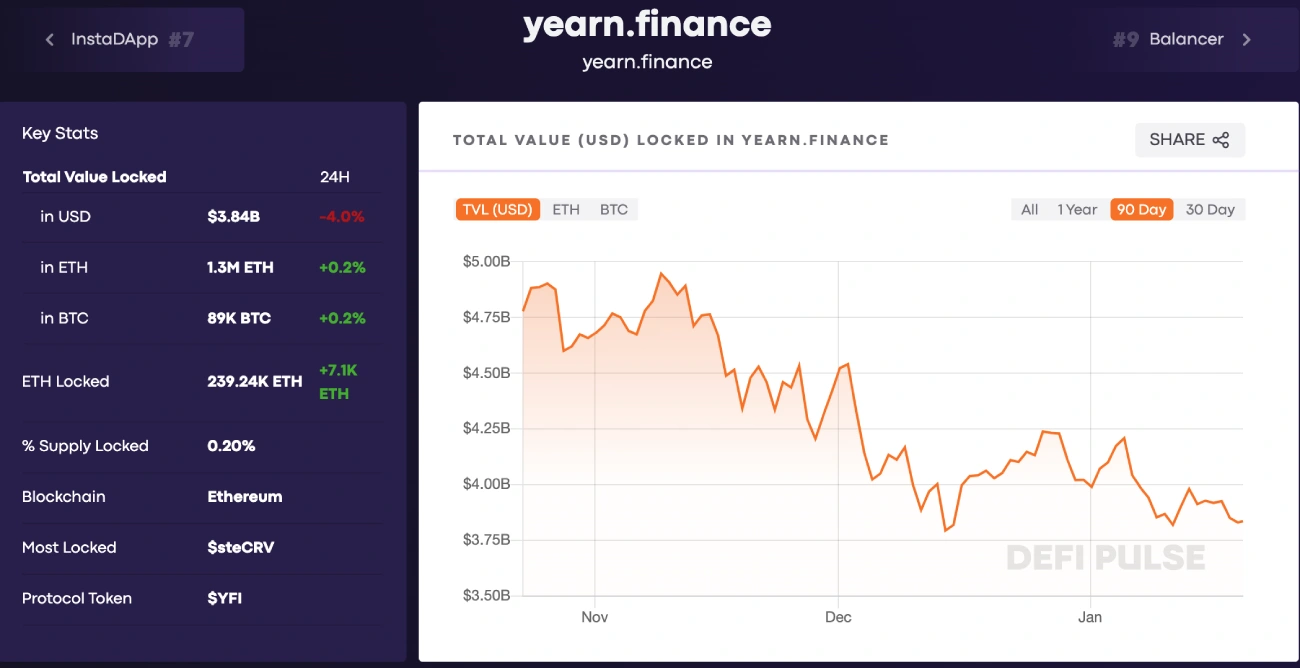

Yearn.Finance

Performance Score: 7.5/10

Total Value Locked: $3.9 billion

Pros

- Users have access to the best ROIs (return on investment).

- One of the most secure DeFi platforms in the market.

- Clients can select interfaces based on their locations.

Cons

- Many have questioned the protocol’s credibility due to its inadequate documentation.

Yearn. finance is an aggregator service for anyone interested in DeFi. It’s a lending and yield farming protocol that employs automation to help investors get the most out of their yield farming investments. Yearn.finance’s Zap is one of the most user-friendly services on the market, and users can “zap” funds in and out of the curve pools via Zap, avoiding transaction fees.

General Information:

· Andre Cronje is the founder of Yearn. finance.

· Yearn. finance’s underlying coin, YFI, is the basis for its protocol. The ecosystem is controlled by YFI token holders who submit and vote on proposals that govern the platform.

· Yearn.finance Twitter community has 174,000 followers.

Key Features:

· Users have access to features like liquidate. finance, trade.finance, iborrow.finance, and yswap.exchange.

· The vault’s (crypto-based software wallet) service is subject to a 2% annual maintenance cost.

· DAI, USDC, USDT, and sUSD are currently supported by Yearn. finance.

Why We Recommend: Yearn. finance offers some of the highest annual percentage yields compared to various DeFi protocols. It has some of the most advanced security features on its platform, and the governance lies with only YFI holders, making it a self-governed platform. Yearn. finance also offers easy and streamlined ways to liquidate funds.

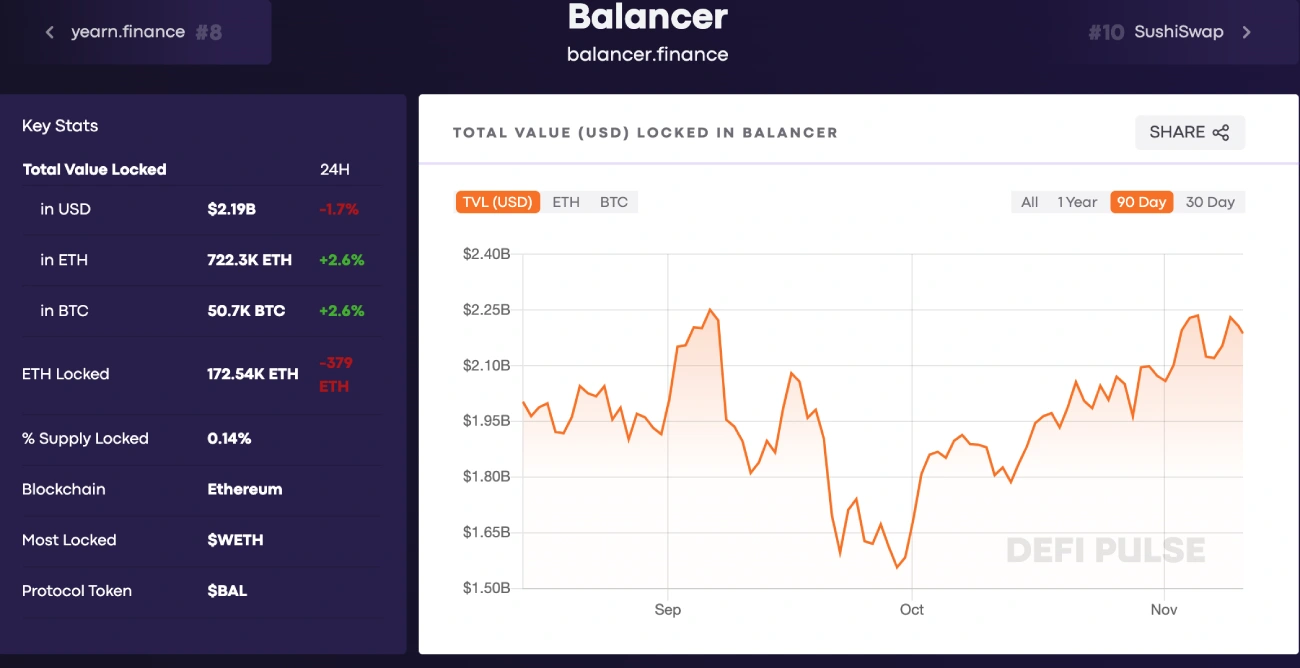

Balancer

Performance Score: 7.0/10

Total Value Locked: $2 billion

Pros

- Novel multi-asset pools.

- The Swap Functionality allows arbitrage operators to earn from refreshing pools.

- Reduced gas fees.

- Custom AMMs.

Cons

- Danger of impermanent loss.

- A big hack occurred in 2020, leading to the theft of $500,000 worth of tokens.

Balancer has already made great strides in distinguishing itself from its competitors. It’s a decentralized exchange (DEX) and automated market maker (AMM). The platform enables users to trade any combination of ERC-20 tokens, earn BAL (Balancer’s native governance token), and profit from arbitrages.

General Information:

· Fernando Martinelli is the founder of Balancer.

· It was formally introduced in September 2019.

· BAL is Balancer’s native cryptocurrency token.

· Balancer has 119,000 followers on Twitter.

Key Features:

Balancer is redefining the notion of decentralized exchanges by providing users with five key products to help them get the most out of their trading experience.

- The Vault;

- Balancer Pools;

- Smart Order Router;

- Merkle Orchard;

- Balancer Gnosis Protocol.

There are two types of pools available at Balancer: public and private pools.

Why We Recommend: The fact that users can construct their private liquidity pools that can include more than two crypto assets makes Balancer stand tall amongst other platforms. Interestingly, it also has multi-token pools, giving up to eight unique tokens.

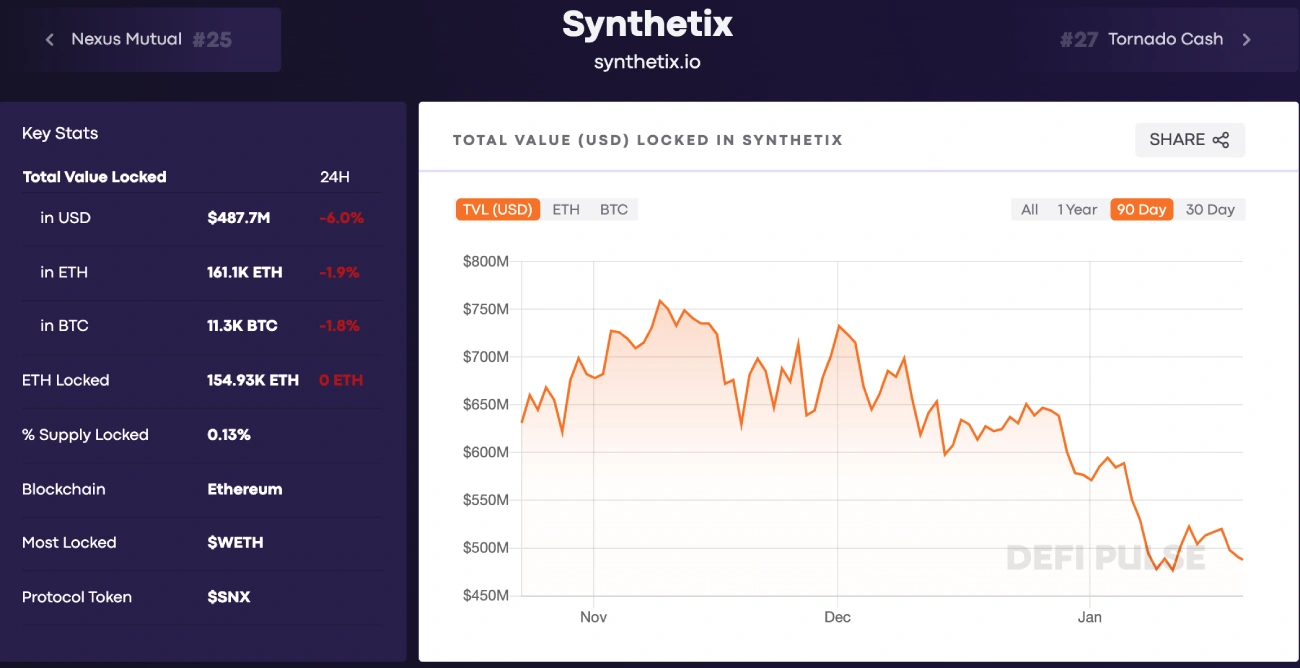

Synthetix

Performance Score: 7.0/10

Total Value Locked: $523 million

Pros

- A decentralized oracle system to detect price fluctuations using smart contracts.

- When trading on this DeFi platform, you don’t need to own assets physically.

- Access to a variety of digital assets.

Cons

- The platform is new and still in development, and as such, there is no assurance of its growth.

- Customers may need to burn additional Synths to activate their SNX token.

- Often experiences centralization troubles.

Synthetix is a system that allows artificial assets to be created on the Ethereum network. The exchange expands the crypto ecosystem’s exposure to non-blockchain assets, resulting in a more mature financial sector. You can find Synthetic assets, for example, synthetic inverse cryptocurrencies, synthetic cryptocurrencies, gold, silver, etc., on Synthetix.

General Information:

· Kain Warwick is the founder of Synthetix.

· The SNX token is an Ethereum-based ERC-20 token.

· Synthetix’s Twitter community has 184,000 followers.

Key Features:

· Synthetix is a blockchain-based platform that gives users access to a wide range of highly liquid synthetic assets (synths).

· These assets offer returns on underlying investments without requiring the user to have direct possession.

· Synthetix is a synthetic asset platform and decentralized exchange (DEX).

Why We Recommend: Synthetix aspires to diversify the crypto landscape by introducing non-blockchain assets. It provides users with access to a vibrant financial market.

Conclusion

DeFi is one of the most important innovations of blockchain technology, revolutionizing global finance. Now is the time for you to explore ways to capitalize on DeFi. In what ways can you use DeFi applications?

Borrowing and lending are among the most common use cases for DeFi applications, but there are many more increasingly complex options, too, such as becoming a liquidity provider to a decentralized exchange. You can earn yield by depositing your crypto assets in DeFi platforms such as Aave or Compound, and these decentralized lending platforms offer you an Annual Percentage Yield.

You can participate in liquidity mining and get rewarded for providing liquidity (capital) to a DEX liquidity pool (Decentralized Exchange).

You can also trade on DEXs. Unlike centralized exchanges, DEXs allow users to make P2P transactions with one another, and as a result, trade smaller altcoins unlisted on centralized exchanges.

It’s been incredible to watch DeFi projects explode in popularity. DeFi is one of the fascinating sectors to monitor, with new decentralized financial services being launched weekly.

FAQs

What Are Some DeFi Platforms

In this post, we have covered some of the best DeFi platforms in the crypto market today. The list and scores are based on the total value locked in each platform and other important metrics.

How Much Money Can I Make With DeFi

The value locked in DeFi applications has skyrocketed, with many users allegedly profiting tremendously. Users may earn passive income by lending money via Ethereum-based decentralized lending platforms.

Yield farming protocols, as previously mentioned, hold the excellent possibility for even higher profits. However, they also come with an increased risk, as these mechanisms are typically complicated and ambiguous.

Is Investing in Defi Safe

DeFi is in its early stages, with several speculations and experiments taking place; as such, investing a portion of your funds in DeFi applications will not disrupt your investment portfolio.

How Many Defi Apps Are in Ethereum

There are 214 DApps, according to DeFi Prime.