After a spectacular climb of over 150% in 2023, Cardano (ADA) has reached a new yearly high, touching a peak of $0.67 for the second time last month.

Notably, the increase coincides with an impressive rise in important Cardano ecosystem components, with the leading Decentralized Exchange (DEX) Minswap witnessing an astounding 26,000% gain and drawing a sizable influx of new users.

On its one-day timeframe, Cardano, the eighth-largest cryptocurrency by market value, and currently trading at $0.61, is now exhibiting optimistic signals. The digital currency’s trajectory indicates that, despite a minor growth of 1.28% over the past week, a retest of the $1 threshold may occur soon.

Monthly stats are here!

Highlights

Trading Volume up BIG (+166.80%) to 300mn USD for the month, mostly from $SNEK and $FREN.

Real yield rewards of 252,963 $ADA to be distributed to $MIN stakers (2.5x times last month!).

$MIN daily Emissions were lowered 5%. pic.twitter.com/ji54mF3jNE

— Minswap Labs (@MinswapDEX) January 1, 2024

Prominent analyst Dan Gambriello emphasizes how Cardano depends on the dynamics of the Bitcoin market to make significant gains. He points out that ADA emerged from a crucial symmetrical triangle and suggests $0.80 as a possible target.

In spite of this bullish forecast, he cautions about the barrier the 200-week moving average presents, indicating a possible obstacle or reassuring element for Cardano’s upward journey.

Cardano Faces Resistance, Struggles Persist

Cardano’s critical resistance zone, according to cryptocurrency expert LuckSide, is $0.60 to $0.67. There are two situations that could occur: an increase to $0.70 or a probable decrease to $0.40.

Notwithstanding regulatory obstacles, such as monitoring from the SEC, the analyst continues to have an optimistic prognosis for Cardano in 2024.

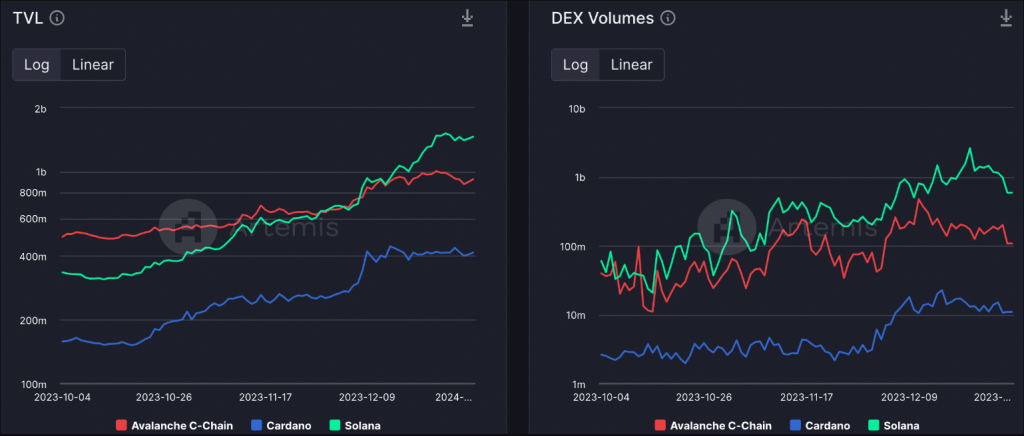

Meanwhile, when comparing Total Value Locked (TVL) and decentralized exchange (DEX) volumes, Cardano has found itself lagging behind prominent platforms such as Solana (SOL) and Avalanche (AVAX).

Despite witnessing significant growth in both TVL and DEX volumes over recent months, Cardano continues to face the challenge of attaining parity with other Layer-1 blockchains. Although strides have been made, reaching a comparable standing remains an ongoing endeavor for the Cardano ecosystem.

The Total Value Locked (TVL) chart shows that Avalanche C-Chain has the highest TVL, followed by Solana and then Cardano. However, all three blockchains have seen their TVL grow in recent months. Cardano’s TVL has grown the most, from about 200 million on October 4, 2023 to about 800 million on January 1, 2024.

The DEX Volumes chart shows a similar pattern, with Avalanche C-Chain having the highest DEX volumes, followed by Solana and then Cardano. However, the growth in DEX volumes has been less pronounced than the growth in TVL. Cardano’s DEX volumes have grown from about 10 million on October 4, 2023 to about 40 million on January 1, 2024.

Overall, the chart shows that Cardano’s TVL and DEX volumes have grown in recent months, but they still lag behind those of Avalanche C-Chain and Solana. This suggests that Cardano is still making progress in the DeFi space, but it has not yet caught up to its competitors.

Cardano (ADA) Price Analysis

The present price movement of Cardano (ADA) is being supported by an upward sloping trendline. If a collapse occurs, it would provide an opportunity for buyers who have been waiting on the sidelines to accumulate more. However, if there is a breakout above a significant obstacle, it might push ADA to higher levels.

Cardano’s inclining trendline suggests that buyers have been stepping in as the price dips down towards the trendline, preventing a significant breakdown.

A breakdown below the trendline could signify a period of weakness for Cardano, potentially leading to further declines. This could be an entry point for “sidelined buyers,” who have not already purchased ADA, to accumulate coins at a discount.

Conversely, a breakout above a key hurdle could trigger a surge in buying pressure, propelling Cardano’s price higher. Identifying this key hurdle on the chart is crucial for understanding the potential upside.

Featured image from iStock