The recent approval of several spot Bitcoin exchange-traded funds (ETFs) by the SEC was expected to usher in an era of mainstream adoption and sky-high prices for the flagship Cryptocurrency. Instead, Bitcoin has crashed over 20% from its 2024 high of $49,000 to just under $39,000 at the time of writing.

Where is the bottom of this crash? Is this a buy the dip opportunity? And most importantly, is this sharp correction the end of the bull market in Crypto? We explore the factors behind the selloff, and why this could ultimately lead to more bullish price action in the top Cryptocurrency by market cap.

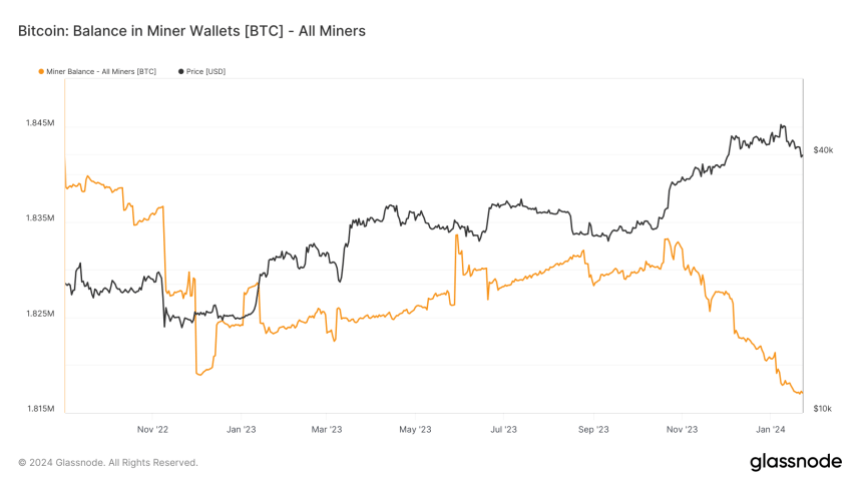

Miners selling Bitcoin at the same time

One major factor driving the decline is miners offloading their Bitcoin onto exchanges at a pace not seen since the FTX collapse in November 2022. The amount of BTC held by miners has plunged, indicating they are selling their newly minted coins instead of the typical strategy of accumulating them as a long-term investment. This surge of sell pressure from miners has overwhelmed buying demand, even as major ETF providers snap up Bitcoin to back their newly launched funds.

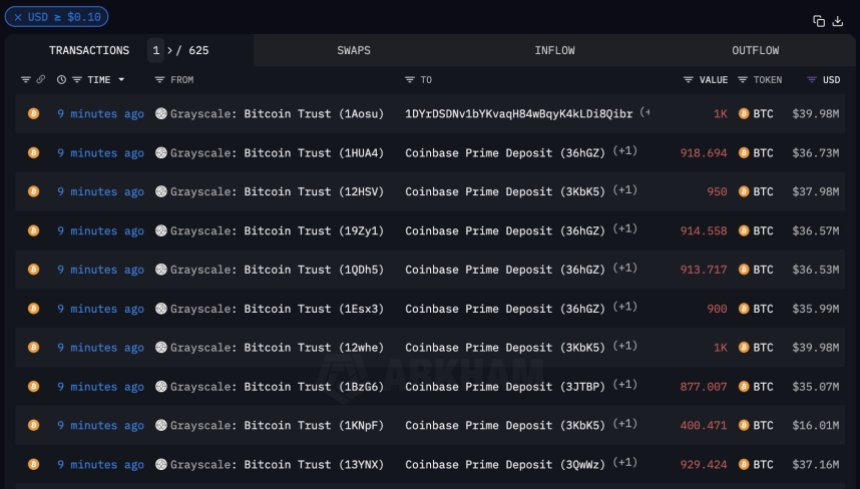

Grayscale outflows adding fuel to the fire

Grayscale Bitcoin Trust has been sending billions in BTC to Coinbase. Grayscale is one of the world’s largest holders of BTC, causing the substantial outflows to have a notable impact on price action. GBTC outflows are being driven by particularly high 1.5% expense fees compared to other spot ETF alternatives in the US. The situation was made worse when FTX’s estate redeemed nearly $1 billion in GBTC. When GTBC holders cash out their shares, a corresponding BTC sale is made.

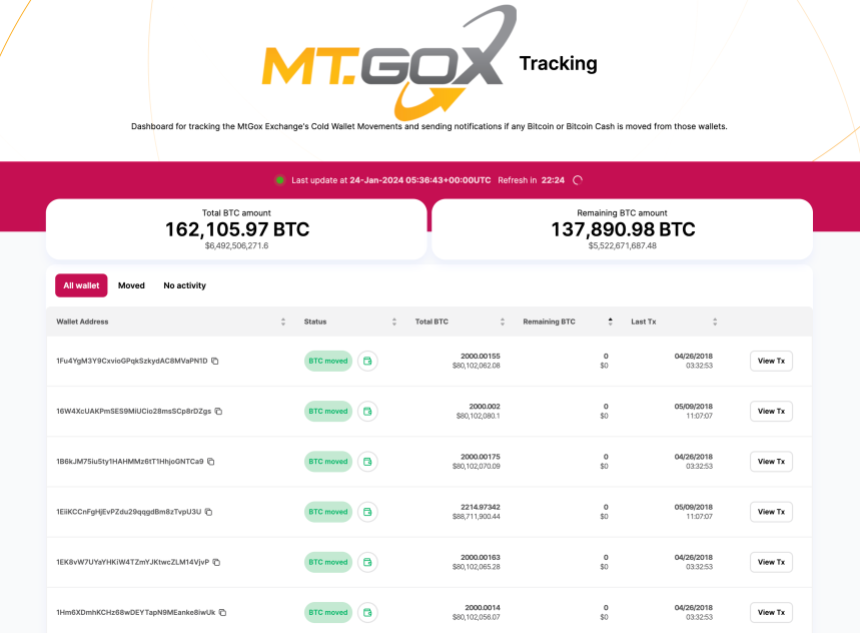

Looming Mt. Gox payouts spooking investors

Also contributing to the skittish sentiment is the long-running Mt. Gox repayment plan nearing its conclusion. The defunct exchange is preparing to distribute 137,000 BTC to holders as restitution for funds lost in its infamous 2014 hack. Many recipients are expected to cash out immediately and could flood the market with sell orders. This impending overhang has investors worrying about whether Bitcoin has enough demand to absorb the extra supply.

Ongoing macroeconomic headwinds

Bitcoin’s ties to risky asset classes mean it has suffered collateral damage from the Federal Reserve’s relentless interest rate hikes and the strong US dollar squeezing alternative assets. Until inflation shows clear signs of slowing down, investors are unlikely to find refuge in Crypto. The Fed’s actions have dashed hopes that loosening monetary policy could stoke Bitcoin’s next bull run.

There may be light at the end of the tunnel

But there are reasons to be optimistic about Bitcoin’s future. For one, miner balances have fallen so dramatically that they are now lower than during last November’s FTX-induced meltdown. This signals that much of the excess selling pressure has already been expended.

As for the Mt. Gox payouts, creditors have held Bitcoin for nearly a decade and may opt to continue holding now that the Crypto winter seems to be thawing, rather than cash out at depressed prices below $40k.

ETFs now account for 0.5% of BTC supply

Most importantly, each newly approved ETF has greedily snapped up the Bitcoin sold into the market over the past weeks, evidenced by their substantial and rapidly growing holdings.

BlackRock’s spot Bitcoin ETF took in a staggering 44,000 BTC worth $1.75 billion within two weeks of launch. At Fidelity’s current pace, its ETF holds 30,000 BTC. With another over 30,000 BTC already under management across the remaining SEC-approved ETFs, these funds combined now hold over 100,000 BTC and counting.

Considering Bitcoin’s max supply is only 21 million, over 0.5% of all Bitcoin in existence is now locked up in just a handful of investment vehicles catering to institutional investors. And the appetite for Bitcoin exposure is only set to grow as more mega-asset managers file for spot ETFs to meet rising demand.

The looming Bitcoin halving could upend the status quo

With miners offloading coins ahead of the Bitcoin halving, and validation rewards about to be cut 50% from 6.25 Bitcoin per block to 3.125 Bitcoin per block this April, Bitcoin’s already decreasing issuance rate is set to drop drastically lower. This quadrennial event has historically choked the influx of new Bitcoins, as only half the number of coins enter circulation post-halving.

Yet despite the turmoil in Crypto markets presently, institutional intrigue in Bitcoin is continuing to scale up. Major asset managers have finally secured SEC approval for spot Bitcoin ETFs to meet surging demand from institutional investors seeking Crypto exposure.

Retail interest also remains resilient. The stage is being set for a serious supply-demand imbalance to play out over 2024. This, in turn, could act as rocket fuel to propel prices higher, as liquid coins become increasingly scarce relative to the swell of new institutional and retail entrants.

If history is any indicator, Bitcoin’s previous halving events triggered spectacular bull runs that saw prices appreciate multiples higher over the following 12-18 months. Investor euphoria reached a fever pitch as mainstream media coverage pulled in waves of new buyers happy to purchase Bitcoin at ever-loftier prices.

The run-up to April’s halving could see a similar pattern emerge. The type of supply shock that may unfold as Bitcoin’s issuance falls off a cliff this spring, while interest continues rising unabated, has the potential to ignite the asset’s next parabolic ascent to new all-time highs.

Turbulence creates opportunity for bold traders

Riding out this period of volatility will require nerves of steel, but for seasoned traders, the swirling uncertainty presents an opportunity. Platforms like PrimeXBT allow traders to benefit from Bitcoin’s wild price swings in either direction through instruments like Crypto Futures contracts and adjustable leverage. Advanced risk management tools are also at traders’ disposal to customise exposure based on personal risk tolerance.

As Bitcoin emerges from its post-halving cocoon over the mid-2020s, this period may be looked back upon as a final cleansing plunge before ascending to new heights on the back of hyper-scarcity and institutional adoption. Those bold enough to take calculated risks could reap outsized returns if faith in Bitcoin’s enduring value proposition holds firm.