Bitcoin has been unable to retain its bullish momentum and seems likely to extend its current downside trend. However, the long run remains positive, and the next months could see BTC reach its all-time high, but in a different fashion than in previous rallies, according to a large investor.

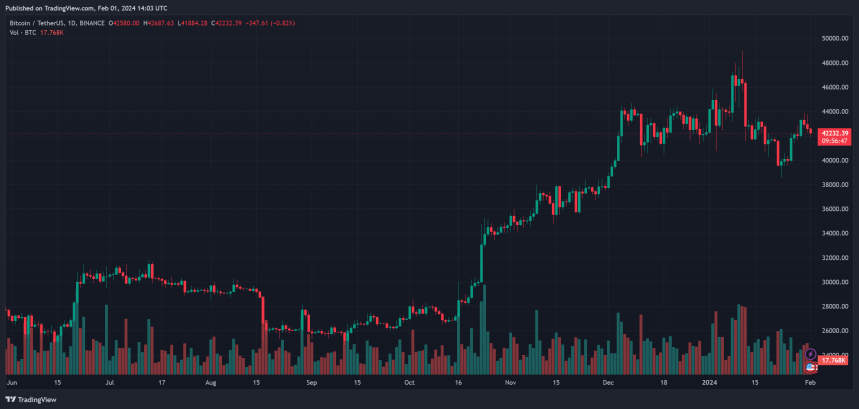

As of this writing, Bitcoin trades at $42,000 with a 1% loss in the last 24 hours. Over the previous week, the cryptocurrency still records a 5% profit.

Bitcoin Whales Makes Bullish Forecast

According to a pseudonym Bitcoin Whale that goes by “Joe007” on social media X, the cryptocurrency is poised for a bull run. The institutions trading the US spot Bitcoin Exchange Traded Fund (ETF) will drive this bullish momentum.

In that sense, these institutions are likely to suck the volatility out of Bitcoin by pushing to trade similar to traditional assets. Thus, Joe007 claims that this cycle’s rally will lack the excitement of 2017 and 2021 when BTC hit $20,000 and $69,000, respectively, creating euphoria amongst investors.

The Bitcoin whale stated:

I think we’re about to witness the most boring rally in Bitcoin history. No retail-driven parabolic swings that excite degens/noobs and produce headlines. Rather a slow relentless drive higher by professional accumulators taking out layer after layer of paper handed holders.

The whale dismissed the possibility when asked if traditional institutions could fail in “taming” BTC due to the “systemic crises” in the space. In addition, Joe007 dismissed the possibility of the cryptocurrency not running higher in the long run.

The only thing that could stand between Bitcoin and a rally is a “low probability” scenario where the traditional finance sector experiences a similar crash to 2008. The BTC whale added:

(…) unless there is a sudden complete tradfi meltdown (2008-style or worse). Then I can see Bitcoin being dragged into a general panic-crash, at least initially. Certainly possible but hard to assign realistic probability.

BTC Price In The Short Term

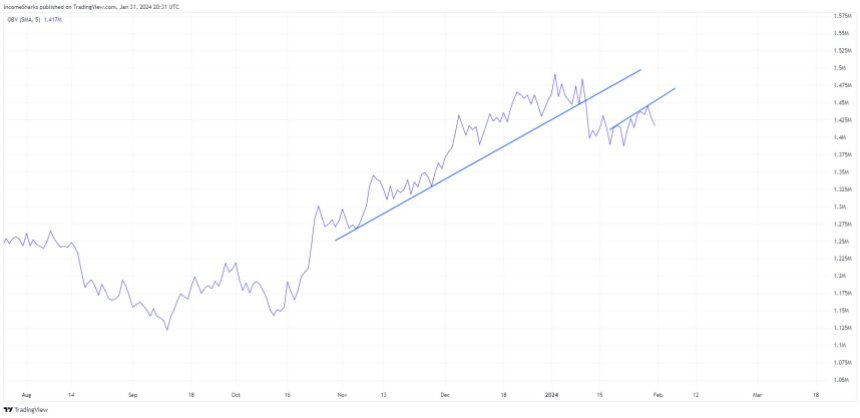

On low timeframes, an analyst pointed at the Daily On Balance Volume (OBV), which suggests further downside for BTC. The chart below shows that this metric broke out of a trending channel during Bitcoin’s recent crash.

The OBV was rejected out of a critical level and seems poised to trend to the upside along with the price of BTC. The analyst stated:

Daily OBV still looks like it wants more downside. Looks like this might have been a lower high that we just put in.

Cover image from Unsplash, chart from Tradingview