Quick Take

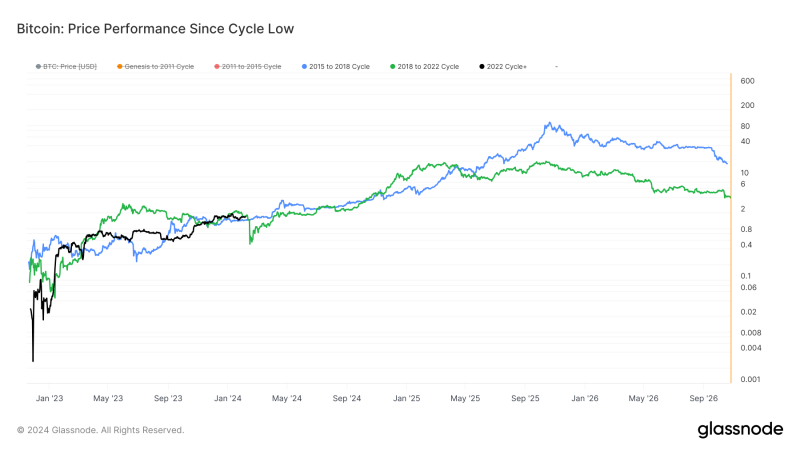

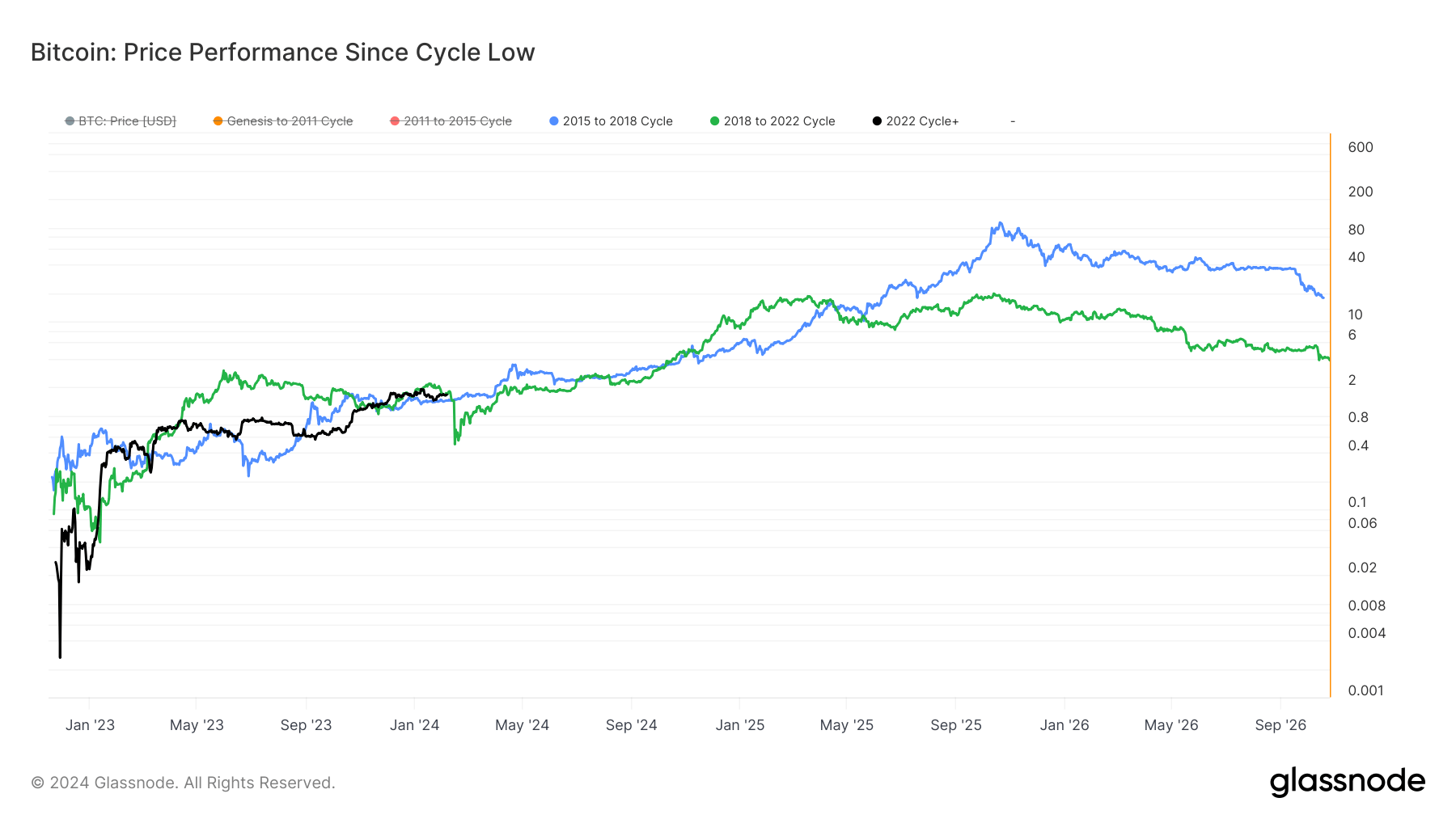

An insightful analysis indicates that Bitcoin is adhering to its historical market trends. In November 2022, during the FTX collapse, Bitcoin plummeted to a low of roughly $15,500, while Bitcoin is now hovering above the $44,000 mark, representing an increase of over 160% from that cycle low. A revealing pattern emerges when compared to previous cycles. In the 2018 to 2022 cycle, Bitcoin was up by 170% at this corresponding cycle point.

Meanwhile, the 2015 to 2018 cycle showcased a 144% increase from the cycle low. This data suggests that the current cycle’s performance of 166% increase is in line with historical trends.

Furthermore, a significant observation is that the majority of the gains usually transpire after the halving event rather than before.

The peak return in the 2015 to 2018 cycle from the cycle low experienced a significant surge of approximately 11,000%. Remarkably, in the 2018 to 2022 cycle, the returns from the cycle low peaked at roughly 1,700%. If the current cycle emulates the trend of these preceding cycles, Bitcoin could potentially witness another effective cycle.

The post Bitcoin’s recovery on track with previous market cycle trends appeared first on CryptoSlate.